Damaged credit due to life events

There are three common reasons money-conscious, or even savvy, people lose their home. Irreputable credit, a compromised title on the property, and unforeseen property damages or maintenance. If any one of these three categories are rundown, it can prevent refinancing. Today we’re going to focus on credit.

Your credit score – also known as a beacon or fico score – is determined by Equifax and or TransUnion. Simply put, they have an elaborate point system which financial institutions use to measure how reliable you are at repaying your loans.

The system operates with the understanding that your past behaviour and attitude towards money is an indicator of future financial performance. It’s a pretty accurate measuring stick until life gets in the way of people with good financial habits.

There’s a broad spectrum of how your credit score can suffer: no credit history, bruised credit to poor credit.

In the case of “no credit”, it can be as simple as you having always preferred to manage your cashflow by paying cash. This may seem like a sure-fire way to not overspend or damage your credit score, however, now there is no evidence that you repay your debts. In a case like this, the solution is to build credit history by finding a financial institution that is willing to grant credit. This could be as simple as opening two credit cards, for example.

When it comes to credit problems, it’s usually the latter half of the spectrum that gets people into trouble and which requires more care to mend.

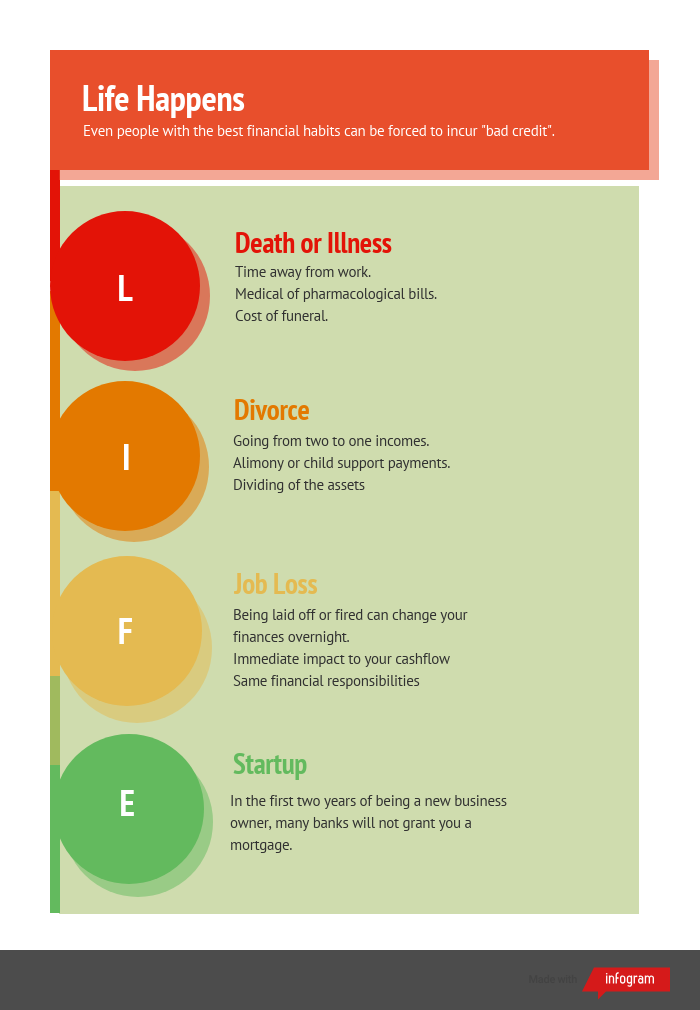

While past behaviours and attitudes towards money often indicate the future financial-performance of an individual, life can force your hand.

Life events can push people with healthy borrowing habits into bruised or even poor credit. Bruised credit is when you start to over extend yourself and “points” are deducted from your credit score. This includes but is not limited to:

- Your ratio of debt to income is inversed

- Over 60% of any given credit line is in use

- You have too many active trade lines

The more aggressive and ongoing these life events become, the more it lowers your credit score. These issues can be marked by:

- R9’s – debt written off by a lender which you could not repay

- In collection – debtors have hired a 3rd party agency to collect on your debts

- Or liens on the title – something we’ll explore next month

These problems can push people into liquidating their assets in a fire sale or even declaring bankruptcy. In cases where people are forced to surrender their home to the financial institution, this could mean having to wait up to eight years before a financial institution will offer another mortgage to these individuals.

People in this position need help with aggressive and creative credit solutions. The first step is to consolidate your debts and have a credit councillor included in your financial team. This person will help you optimize your credit payments by figuring out which debts have the highest effect on the credit score (or beacon) algorithm. If you’re in deep, a licensed regulator can file a Consumer Proposal (CP) on your behalf, settling your debts for a percentage of the rate over five years. Some financial institutions are able to drastically shorten this period. PENTOR Finance, for example, has a program which assists clients through the CP process that can obtain the necessary certificates from the court liberating you from your debts in a period of 45-60 days.

At the end of the day, one negative life event can force you to incur “bad credit” – destroying your credit in the eyes of traditional financial institutions. With the right financial team supporting you through hard times, you can improve or even rebuild your financial reputation and get back on track.

I'm waiting for your call or email to answer your questions!

Ryan La Haye

T. 450.629.3101

rlahaye@planipret.com

1545 de l’Avenir, suite 220

Laval, Québec H7S 2N5